On the other hand, the State Tax ID (which is also called ‘State Employer Identification Number’ or ‘SEIN’) is issued to companies so they can hire employees, offer products/services, apply for loans, and pay taxes on the state they are currently operating.

#State tax id number lookup how to

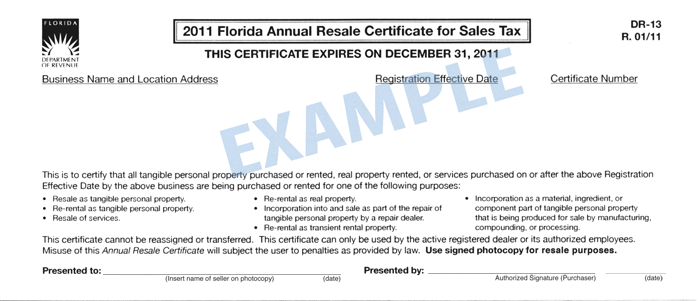

It has nine digits (XX-XXXXXXX), and it functions like the Social Security Number for individuals.Īlso, the EIN must be requested just one time, and it does not change if you want more details about how to do it, this article will help you.ĭisclaimer: If you live in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, it is not mandatory since these states do not collect income taxes. It is essential to pay federal taxes, and it is requested on the paperwork that must be submitted. The EIN is a number issued by the IRS to identify any company or business.Process to request tax ID numbersįirst, you need to understand the difference: They are not the same, but they are related, so the process to request or locate them is very simple you do not need to hire any third-party services. The first one is the Employer Identification Number (EIN), also called the ‘Federal Tax ID number’ the second is the State Tax ID number, which you can request once you have the EIN. Keeping this in mind, they also need to register and receive an ID number from both the Internal Revenue Service (IRS) and their state’s Department of Taxation. Any company or organization that plans to hire employees, open a bank account, and generate income will obviously have to pay taxes.

0 kommentar(er)

0 kommentar(er)